Bath vs Shower: The Key Differences to Consider in 2025

When comparing a shower vs bath, the differences go far beyond water temperature and timing—they reflect your lifestyle, space, and

Shopping for a home is one of life’s most exciting yet daunting milestones. Before diving into the housing market, it’s crucial to understand the various financial factors that influence the affordability of a home. This article breaks down the key elements that determine how much annual income is necessary to afford a median-priced home in different US states.

The most significant factor affecting home affordability is the median home sale price, which can range dramatically across the country, from $238,300 in Mississippi to $852,900 in California. Higher home prices naturally require higher incomes to afford.

Effective tax rates also play a critical role; states with higher tax rates, like New Jersey (2.23%), elevate the annual cost of homeownership, thereby increasing the required income.

The average debt-to-income ratio, representing the proportion of monthly debt payments to gross income, affects the ability to afford homes, with ratios varying from 0.755 in New York to 2.06 in Hawaii.

Additionally, insurance premiums for homeowners, which vary from $802 in Hawaii to $5,375 in Kansas, can add substantial costs.

The cost of living index, indicating daily expenses, ranges from 90.5 in Mississippi to 133.5 in Hawaii. A higher cost of living index means higher daily expenses, necessitating a higher income for a comfortable lifestyle.

Together, these factors provide a comprehensive view of housing affordability across different states.

Key Findings

More Interesting Observations

The affordability of homes is primarily influenced by several key factors:

1. New York

New Yorkers need an annual income of $195,563 to afford a median-priced home of $541,700, which is the seventh highest nationwide. Despite having the country’s lowest average debt-to-income ratio (0.755) and comparatively low average home insurance cost ($2,322), the state still has the highest income requirement for owning a house due to a high effective tax rate (1.40%) and a high cost of living index (107.8) when compared to other states.

2. Massachusetts

In Massachusetts, an annual income of $134,311 is needed to buy a typical home. The second highest income requirement for homeownership is driven by the median home sale price of $634,100 and the living cost index of 116.1, both individually ranked as the fourth highest among all US states. Besides, Massachusetts also has a moderately high effective tax rate (1.05%). However, the average debt-to-income ratio (1.28) and average home insurance cost ($2,016) are quite low here compared to other places.

3. California

California has the most expensive median-priced homes at $852,900, which drives up the annual income necessary to purchase one to $121,587. The income requirement is further elevated by the high debt-to-income ratio of 1.78 and living cost index of 114.1. California, however, has a moderately low effective tax rate (0.75%) and low average home insurance cost ($1,804).

4. Hawaii

The tropical paradise that is Hawaii has the second most expensive median home price ($784,700). So, aspiring homeowners need an annual income of $100,384 to afford an average home here. Notably, Hawaii has the lowest effective tax rate (0.32%) and average home insurance cost ($802), while also having the highest average debt-to-income ratio (2.06), and the highest cost of living index (133.5) in the country.

5. New Jersey

A typical New Jersey home requires $97,431 in annual income to purchase. Here, the median home price is $510,400, which is the tenth highest nationwide. The high income requirement is primarily due to the highest effective tax rate (2.23%) and a high cost of living index (106.6). In addition, New Jersey has a moderately high average debt-to-income ratio (1.55). The state, however, has low average home insurance cost of $1,895.

6. Washington

A median-priced home in Washington costs $654,400, the third highest in the country, which requires an annual income of $96,270 to afford. This is due to a high cost of living index (109.8) and a moderately high average debt-to-income ratio (1.66). However, Washington has moderately low average home insurance cost ($2,026) and a low effective tax rate (0.57%).

7. New Hampshire

The average house price in New Hampshire is $483,500, meaning that an aspiring homebuyer needs to earn $90,852 a year. That’s not surprising, as the state has the second-highest cost of living index (121.7), third-highest effective tax rate (1.93%), and a relatively high average debt-to-income ratio (1.66). Notably, New Hampshire also has the second-lowest average home insurance cost ($1,489).

8. Connecticut

To afford a $424,000 median-priced home in Connecticut, one must earn $87,498 annually. Due to a high effective tax rate (1.79%) and a high cost of living index (111.4), owning a home here requires a high annual income. Meanwhile, Connecticut’s average debt-to-income ratio (1.45) is moderate, and average home insurance cost ($2,699) is moderately low.

9. Rhode Island

In order to buy a home in Rhode Island, where the median price is $489,100, an individual must make $84,909 annually. Because of the fifth-highest cost of living index (115.4), a high effective tax rate (1.40%), and a high average debt-to-income ratio (1.66), homeownership has a high-income requirement. However, the average home insurance cost ($2,404) here is moderately low.

10. Texas

With the average cost of a home in Texas being $352,500, the buyer's annual income must be $78,598. This high-income requirement for homeownership is mainly due to a high effective tax rate of 1.68% and a high average home insurance cost of $4,399. Texas, however, has a moderately low average debt-to-income ratio (1.28), and a low cost of living index (96).

1. Mississippi

Prospective homeowners in Mississippi need an annual income of $39,880 to afford a typical home at $238,300, the second lowest among all US states. Despite the high average home insurance cost ($3,762), Mississippi requires the lowest earnings to buy a typical home due to a low effective tax rate (0.67%), a moderate average debt-to-income ratio (1.55), and a low cost of living index (93.2).

2. Louisiana

In Louisiana, an annual income of $47,061 is needed to buy a median-priced home. The second lowest income requirement for homeownership here is primarily due to the median home sale price of $254,400 and the effective tax rate of 0.56%, both of which individually rank as the fifth lowest in the country. The state also has a moderate average debt-to-income ratio (1.45), and a moderate cost of living index (98.8). However, the average home insurance cost of $4,169 is relatively high here.

3. Alabama

A person earning $47,804 a year can buy a typical home in Alabama. The average home in this area is reasonably inexpensive, at $278,600, and the effective tax rate of 0.40% is the second-lowest in the country. Besides, the average debt-to-income ratio (1.45) is moderate, and the cost of living index (95.6) is considerably low. However, Alabama has a relatively high average home insurance cost ($3,778).

4. South Carolina

In South Carolina, an annual income of $48,691 is needed to buy a median-priced home at $385,800. The state has a low-income requirement for homeownership despite a high average debt-to-income ratio (1.95). This is because the effective tax rate is low (0.57%), the average home insurance cost is moderate ($3,200), and the cost of living index is also moderate (100.5).

5. Indiana

The median price of a home in Indiana is $255,400, and one needs to make $49,069 a year in order to buy one. Due to a low cost of living index (95.1), a moderately low average debt-to-income ratio (1.36), moderate average home insurance cost ($3,461), and a moderately low effective tax rate (0.84%), the requirement for homeownership is quite affordable here.

6. Missouri

A person with a $51,188 annual income in Missouri can buy a typical house that costs $261,000. The state's average home insurance cost is somewhat high ($3,903), but the homes here are still reasonably priced due to a moderate effective tax rate (1.01%), a moderately low average debt-to-income ratio (1.36), and the fifth lowest cost of living index (93).

7. Delaware

In Delaware, a median-priced home costs $352,700, and an annual income of $51,401 is needed to afford one. While the debt-to-income ratio is moderate (1.66) and the cost of living index is slightly above average (103.6), factors like low effective tax rates (0.61%) and the nation's fifth lowest average home insurance cost ($1,760) significantly contribute to the affordability of homes here.

8. Arkansas

A comparatively low yearly income of $51,593 is needed in Arkansas to buy an average house at $257,400. This is due to a low effective tax rate (0.64%), a low average debt-to-income ratio (1.36), and a low cost of living index (96.7). However, Arkansas has a relatively high average home insurance cost ($4,701).

9. Nevada

In Nevada, a slightly higher but still comparatively low annual income of $53,767 is needed to buy a median-priced home at $451,300. A moderately low effective tax rate (0.98%), a relatively low average home insurance cost ($1,884), and a low cost of living index (92.3) result in the low income requirement for homeownership here, despite a high average debt-to-income ratio (1.95).

10. Michigan

People living in Michigan must have an annual income of $54,922 to afford a typical home at $255,500. The state has a low effective tax rate (1.38%), a relatively low average home insurance cost ($2,782), and a low cost of living index (98). However, the average debt-to-income ratio (1.28), however, is high here.

Conclusion

In summary, understanding the income required to afford a home in various states involves analyzing multiple financial factors beyond just the home price. By considering the median home sale price, effective tax rate, average debt-to-income ratio, insurance premiums, and cost of living index, prospective homebuyers can gain a clearer picture of housing affordability across the US.

For instance, New York demands the highest annual income ($195,563) due to its high median home price and living costs, despite having a low average debt-to-income ratio and relatively low insurance premiums. On the other end, states like Mississippi and Louisiana require much lower incomes due to their lower home prices, tax rates, and cost of living indexes. These disparities emphasize the importance of location when considering homeownership, as famously echoed in the real estate mantra, "location, location, location."

By examining these factors, prospective homebuyers can make informed decisions about where they can afford to live comfortably. Whether aiming for the bustling streets of New York or the more affordable landscapes of Mississippi, understanding these economic indicators is crucial for navigating the complex housing market and achieving the dream of homeownership.

Methodology:

Owning a home is a significant milestone for many individuals and families, but it often comes with financial considerations beyond the initial purchase price. Beyond the down payment and monthly mortgage payments, one must also account for property taxes, homeowner's insurance, and potentially private mortgage insurance (PMI). This analysis provides insights into the annual before-tax income needed to cover these expenses, helping individuals gauge their affordability and plan accordingly.

Data Sources

This analysis employs a standardized methodology to calculate the annual income required for homeownership. The process accounts for mortgage principal, interest, property tax, and homeowner's insurance payments. Key assumptions include a 20% down payment.

Loan Amount Determination:

Mortgage Payment Computation:

Where:

Property Tax and Homeowner's Insurance Calculation:

Total Monthly Housing Cost Determination:

Cost of Living Adjustment:

Required Annual Income Estimation:

** Down Payment Consideration**

While not explicitly employed in this iteration, for down payments less than 20%, private mortgage insurance (PMI) costs would be factored into the total housing cost. PMI costs vary based on factors such as loan amount, credit score, and loan-to-value ratio, influencing the final income requirement and thus for simplification was excluded from this study.

Why are the 30-year fixed mortgage rate values the same across all states in the dataset?"

The 30-year fixed mortgage rate is consistent across all states in the dataset and reflects a national average. This standardization simplifies comparisons and calculations across different regions, making it easier to evaluate housing affordability uniformly. Mortgage rates are more influenced by national economic factors such as inflation, monetary policy, and overall market conditions than local variations. Using a national average, the dataset ensures that affordability metrics remain consistent and unbiased across different states when comparing.

Torben Fluke is a seasoned data analyst and researcher with over a decade of experience. His latest research, “Unlock Your Dream Home: See the Income Required to Buy a Home in America 2024,” provides valuable data and analysis for aspiring homeowners. When he’s not diving into the numbers, Torben enjoys hiking, exploring new cities, and spending time with his family.

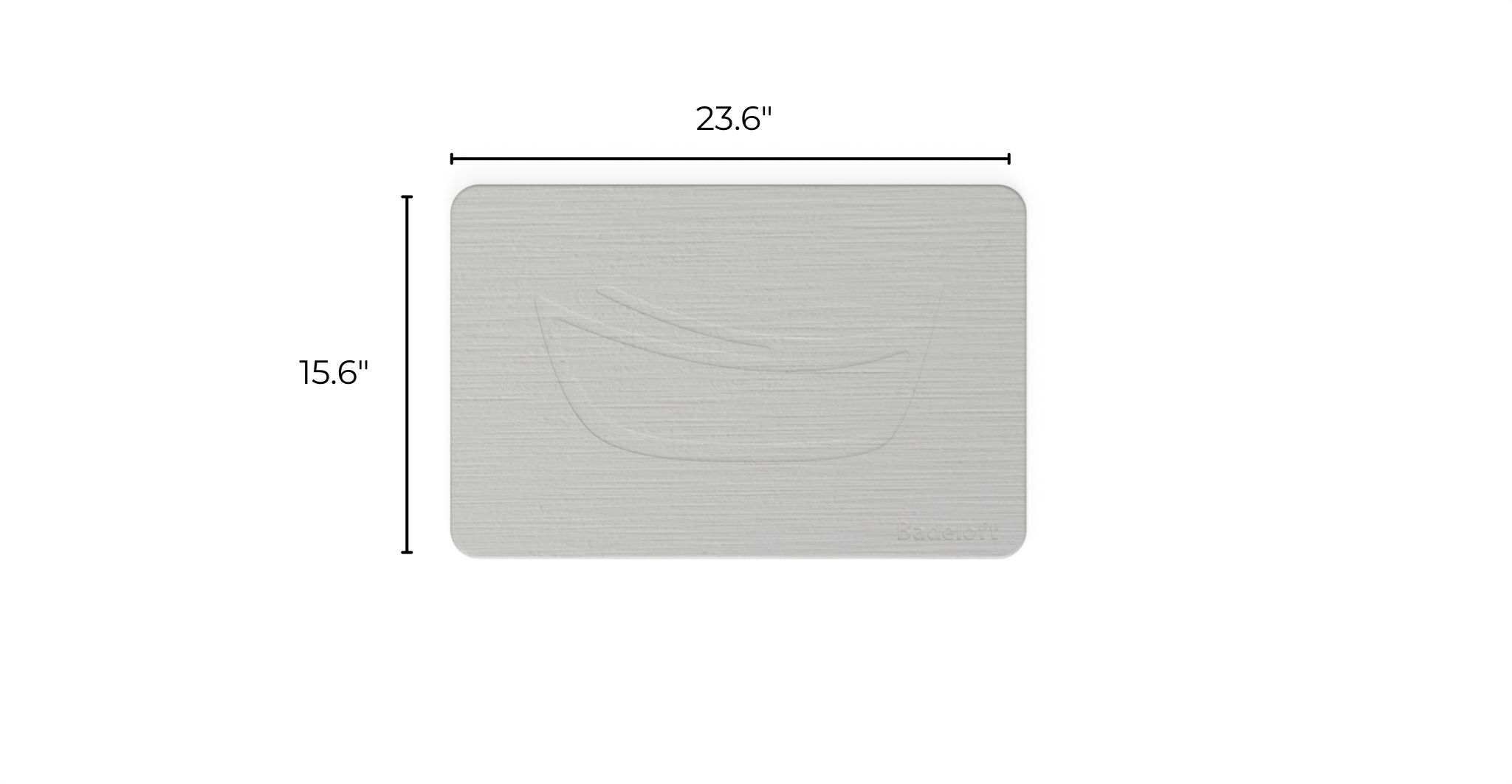

Free material samples and tub templates

When comparing a shower vs bath, the differences go far beyond water temperature and timing—they reflect your lifestyle, space, and

In 2025, bath mats are doing more than just soaking up water—they’re adding comfort, enhancing safety, and complementing the style

Bath mats may seem like a small detail, but their price can vary significantly based on material, size, brand, and

Choosing the right bath mat size is essential for both function and style. Whether you’re outfitting a compact powder room

Fill out the form below to request a free material sample

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields